Investment Planning

Creating a Balanced Portfolio for Financial Stability

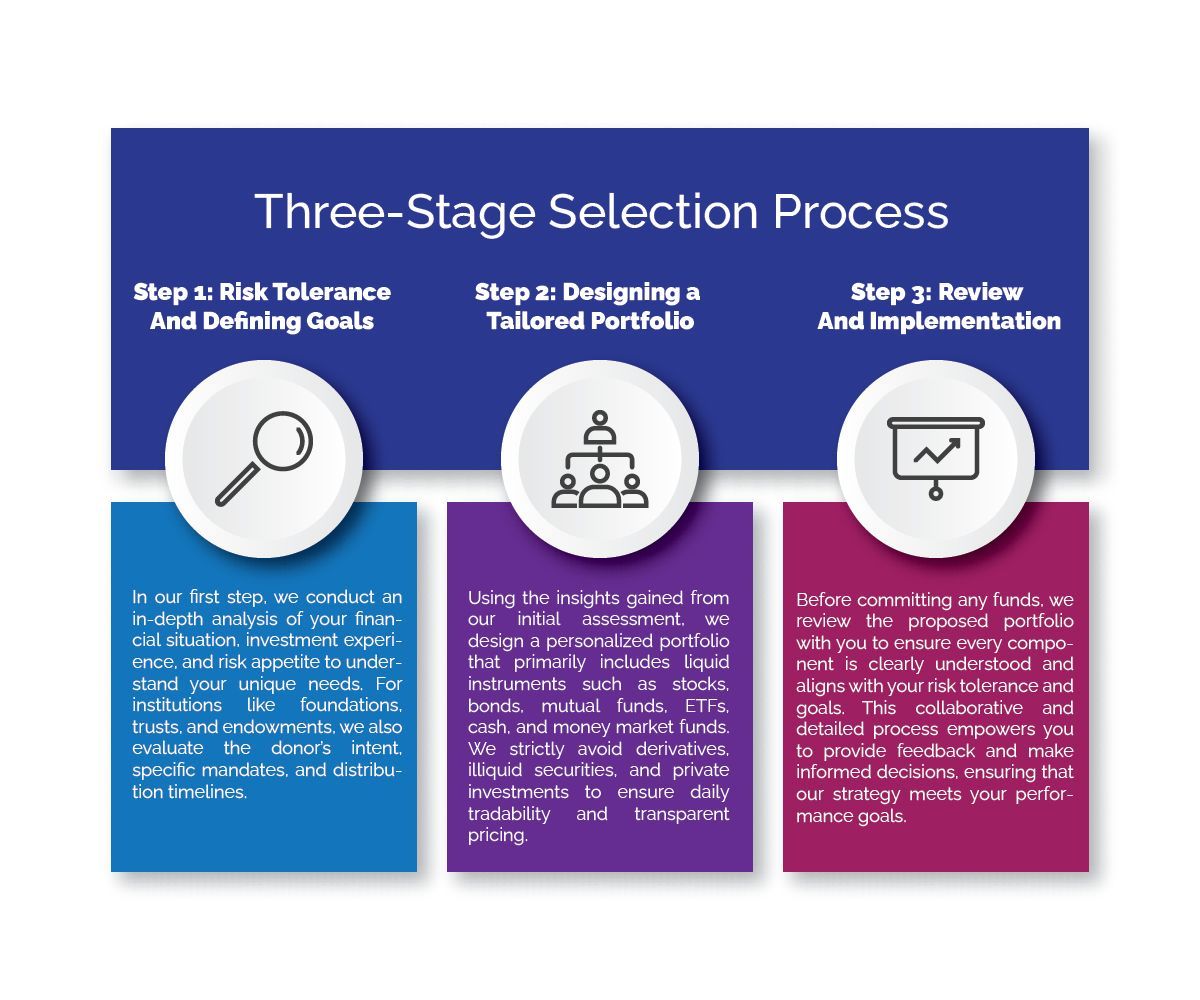

Financial planning is more than just saving money—it’s about creating a clear, actionable strategy that aligns with your goals, lifestyle, and future aspirations. At Optimum Financial, we take a comprehensive approach to financial planning, ensuring that every piece of your financial puzzle works together—from retirement planning and investments to tax strategies and insurance protection.

Whether you’re just starting out, preparing for retirement, or looking to build long-term wealth, our step-by-step financial planning process will help you gain clarity and confidence in your financial future.

Investing Isn’t About Gambling—It’s About Long-Term Strategy

For middle-aged and retired investors, the primary goal of investing is financial security—not speculation.

A well-structured investment portfolio must:

Provide stable, predictable income

Protect against major market downturns

Keep up with inflation so your money doesn’t lose value over time

Understanding Investment Options

Many investors nearing retirement wonder:

- Should I be in stocks or bonds?

- How do I generate passive income from my portfolio?

- What is the safest way to grow my savings without unnecessary risk?

At

Optimum Financial Services, LLC, we focus on

building portfolios that are customized for your needs.

No two investors are alike, which is why every investment plan is created based on

risk tolerance, income needs, and market conditions.

The Importance of Risk Management

One of the biggest mistakes investors make as they age is failing to adjust their investment strategy. A portfolio that worked well in your 30s and 40s may no longer be suitable in your 50s, 60s, and beyond.

Explore Your Investment Options—Learn how to protect and grow your wealth.