About Us

Putting You First, Every Step of the Way

Founded on a commitment to transparency and personalized service, Optimum Financial Services, LLC was established with one clear goal: to empower our clients with investment strategies that are as unique as their financial aspirations. We recognized early on that every investor deserves a tailored approach—whether you’re an individual or represent an institution like a trust, foundation, or endowment. Our journey has been one of continuous learning and innovation, allowing us to build enduring relationships founded on trust and shared success.

Our Approach

A Team Committed to Your Success

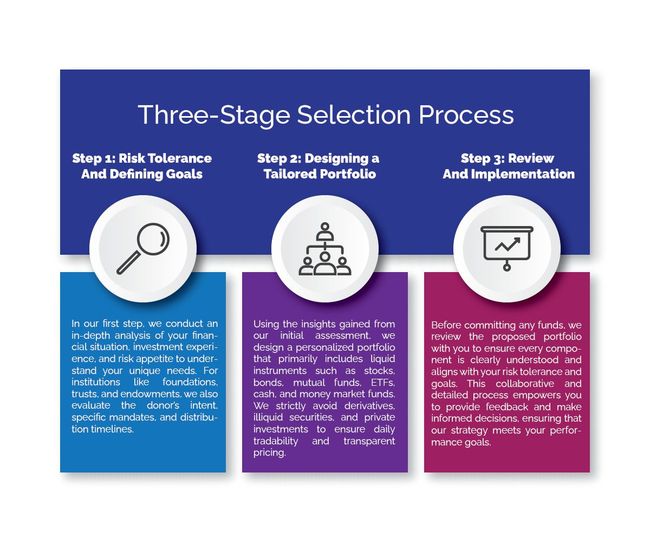

Our process is built around three essential stages:

- Assessing Risk Tolerance and Defining Goals: We start by engaging in a comprehensive discussion about your financial situation, investment experience, and objectives—ensuring that every aspect of your profile is understood.

- Designing a Tailored Portfolio: Based on these insights, we craft a personalized investment portfolio composed of liquid instruments, avoiding complex derivatives or illiquid assets, so your investments remain accessible and transparent.

- Review, Client Approval, and Implementation: We work closely with you to review and refine the proposed strategy, ensuring that every decision is well-informed. Once approved, our team actively manages the portfolio, leveraging both technical and fundamental analysis to navigate market changes.

Our Philosophy

At the heart of our firm is a client-first philosophy that drives every decision we make. We believe that effective investing begins with understanding each client’s unique risk tolerance, financial situation, and long-term objectives. This belief guides our disciplined approach to constructing portfolios that are transparent, liquid, and designed to generate risk-adjusted returns, ensuring you have clarity and confidence in your financial future.

Our History

Decades of Experience, One Shared Mission

Optimum Financial Services, LLC was founded on the belief that investment management should be transparent, client-focused, and strategic. The firm’s roots trace back to 2007, when John Garrard, a seasoned investment advisor with over 30 years in the industry, sought to create a client-first firm that prioritized fiduciary responsibility, tailored financial guidance, and data-driven investment strategies.

John’s career in investment advising began in 1990, working with A.G. Edwards, Legg Mason, Wood Walker, and Smith Barney before founding Optimum Financial Services. His vision was simple: offer personalized, research-driven portfolio management with a focus on risk assessment and long-term wealth preservation.

In the years since, Optimum Financial Services has grown into a respected investment advisory firm serving a diverse clientele throughout Mississippi and beyond. The firm has expanded its expertise with team members specializing in financial planning, risk management, technology-driven investment strategies, and client services.

Our Commitment to You

Whether you’re planning for the future, managing your investments, or looking for a strategic tax plan, our team is here to guide you every step of the way.

Who We Serve

Individuals & Families

If you’re in your peak earning years, setting up a strong financial foundation is critical for both short-term stability and long-term security. We help individuals and families develop smart saving habits, plan for major life events, and build lasting wealth.

Retirees & Pre-Retirees

After decades of working and saving, transitioning into retirement income planning can be overwhelming. We help retirees and pre-retirees develop personalized strategies that ensure a smooth shift from earning a paycheck to living off their accumulated wealth.

Business Owners & Entrepreneurs

As a business owner, you’re focused on running and growing your company. But financial planning is just as important for your business’s long-term success as it is for your personal wealth. We help entrepreneurs strategically manage cash flow, protect their businesses, and plan for succession.

Teachers & Educators

Between lesson planning, grading, and helping students succeed, teachers often don’t have time to navigate their own financial future. We specialize in helping educators understand pension plans, maximize retirement savings, and coordinate benefits for a secure future.

Financial Planning for Women

Women often take on multiple financial responsibilities—from growing careers to managing family finances, planning for retirement, or navigating life changes such as divorce or widowhood. We offer personalized financial strategies designed to provide stability, security, and confidence at every stage of life.